Peer-reviewed publications

- A dynamic model of the racial wealth gap [pdf]

with Ellen Lu and James Paron

Conditionally accepted at the Review of Financial Studies

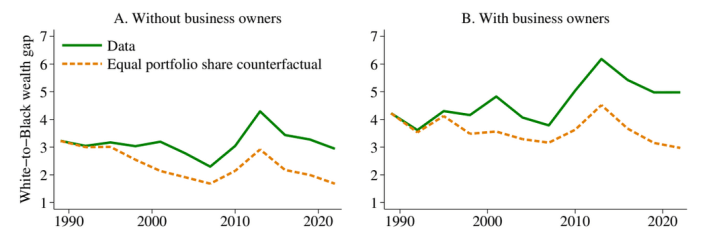

We show that disparities in economic factors can explain differences in the composition of Black and White households’ balance sheets. In a dynamic setting, economic factors often change optimal saving rates in ways that offset their monetary cost or their effect on expected returns to wealth. Consequently, their net effect on wealth is often limited, making the racial wealth gap harder to explain. We estimate that differences in income levels, income risk, family structures, mortality, health expenditures, property taxes, mortgage rates and asset returns can explain half of the differential between the racial wealth gap and the racial income gap.

Contribution of portfolio share to the evolution of the racial wealth gap

- How Do Income-Driven Repayment Plans Benefit Student Debt Borrowers? [pdf]

with Mehran Ebrahimian and Constantine Yannelis

Accepted at the Journal of Financial Economics

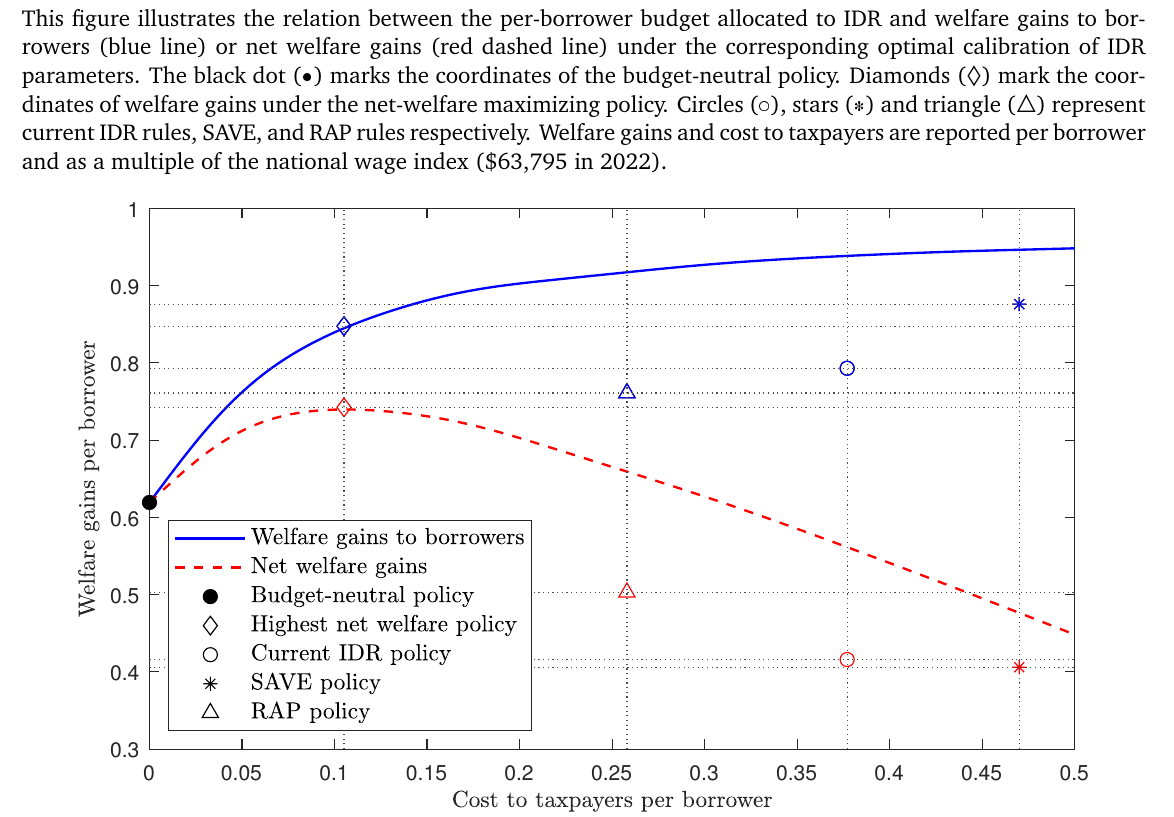

Using credit bureau data, we show that nearly half the increase in student debt since 2010 is due to deferred payments and the expansion of income-driven repayment (IDR) plans. These plans help borrowers smooth consumption, insure income risk, and reduce the effective debt cost. Using a life-cycle model, we quantify the welfare gains from this payment deferment and the channels through which welfare increases. We show that an optimally calibrated plan can achieve similar welfare gains at a much lower cost to taxpayers, and without encouraging additional borrowing. Finally, we use our quantitative framework to evaluate recent proposals to reform IDR rules.

Welfare gains and policy budget under optimal IDR calibration

- Social Security and Trends in Wealth Inequality [pdf][appendix][replication package]

with Max Miller and Natasha Sarin, Journal of Finance, 2025

— Dimensional Fund Advisors prize for best paper in the Journal of Finance (first prize)

— Best paper in asset pricing, SFS Cavalcade

— Best paper, Red Rock Finance Conference

— Marshall Blume Prize in Financial Research

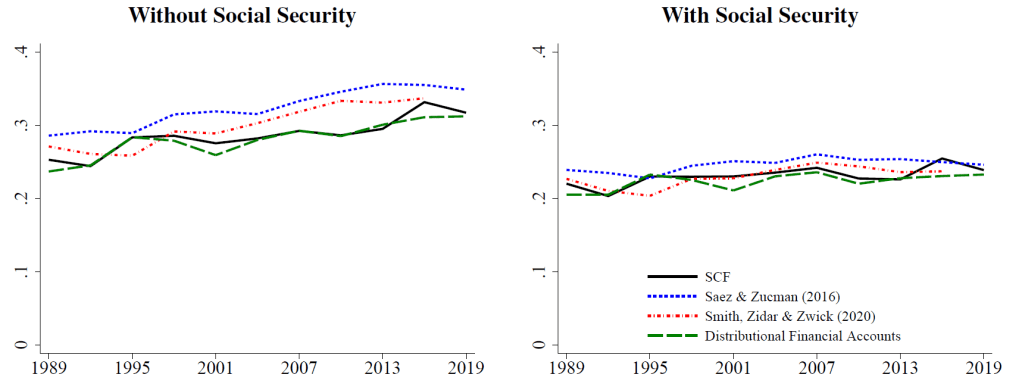

Recent influential work finds large increases in inequality in the United States based on measures of wealth concentration that notably exclude the value of social insurance programs. This paper shows that top wealth shares have not changed much over the last three decades when Social Security is properly accounted for. This is because Social Security wealth increased substantially from $7.2 trillion in 1989 to $40.6 trillion in 2019 and now represents nearly 50% of the wealth of the bottom 90% of the wealth distribution. This finding is robust to potential changes to taxes and benefits in response to system financing concerns.

Top 1% wealth share with and without Social Security

- Countercyclical Income Risk and Portfolio Choices: Evidence from Sweden [pdf][appendix][replication code]

with Paolo Sodini and Yapei Zhang, Journal of Finance, 2024

— Dimensional Fund Advisors prize for best paper in the Journal of Finance (distinguished paper)

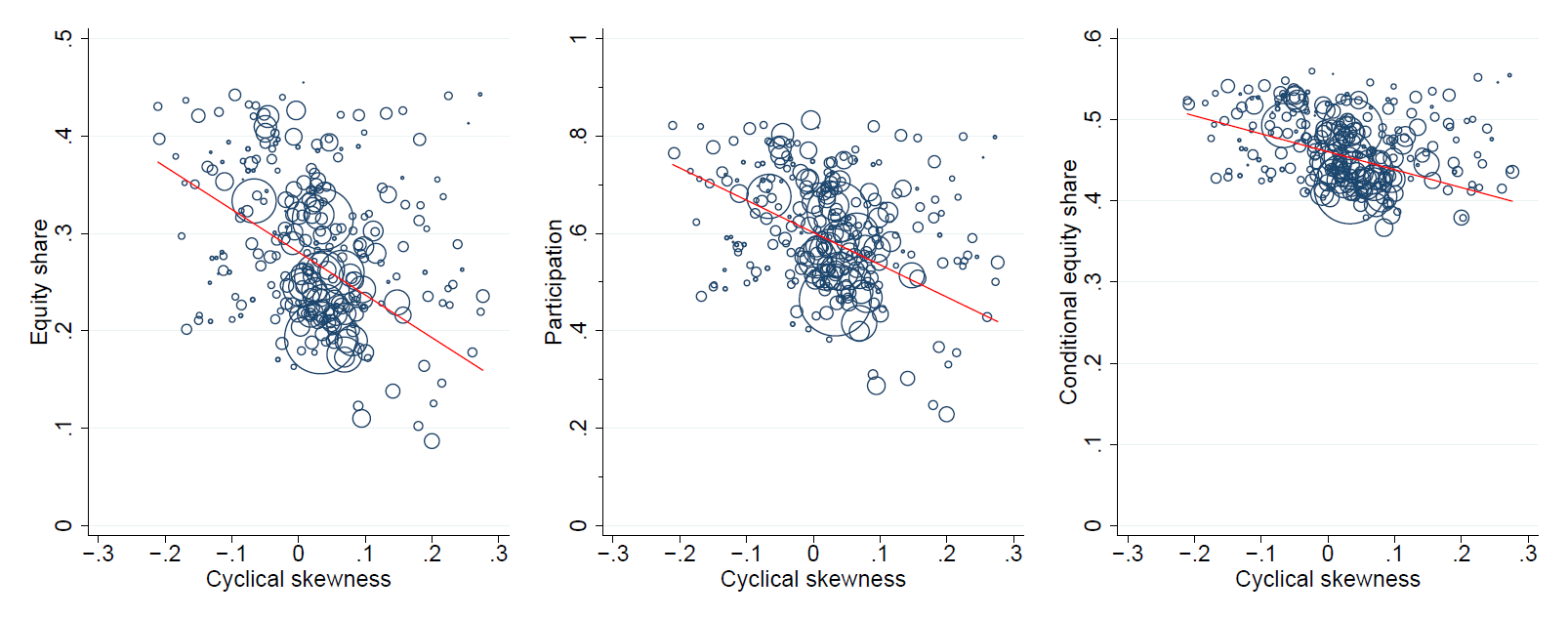

Using Swedish administrative panel data, we document that workers facing higher left-tail income risk when equity markets perform poorly have lower portfolio equity share. In line with theory, the relationship between cyclical skewness and stock holdings increases with the share of human capital in a worker’s total wealth and vanishes as workers get closer to retirement. Cyclical skewness also predicts portfolio differences within pairs of identical twins. Our findings show that households hedge against correlated tail risks, an important mechanism in asset pricing and portfolio choice models.

Equity holdings and cyclical skewness by occupation

- The Distributional Effects of Student Loan Forgiveness [pdf][appendix][replication package]

with Constantine Yannelis, Journal of Financial Economics, 2023

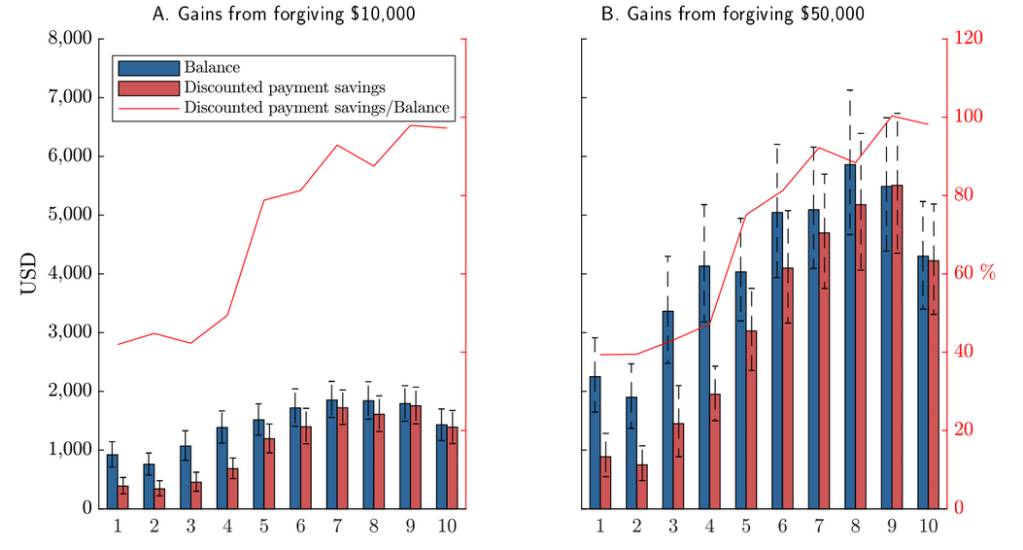

We study the distributional consequences of student debt forgiveness in present value terms, accounting for differences in repayment behavior across the earnings distribution. Full or partial forgiveness is regressive because high earners took larger loans, but also because, for low earners, balances greatly overstate present values. Consequently, forgiveness would benefit the top decile as much as the bottom three deciles combined. Blacks and Hispanics would also benefit substantially less than balances suggest. Enrolling house- holds who would benefit from income-driven repayment is the least expensive and most progressive policy we consider.

Gains from partial student debt forgiveness by decile of income

- Quantifying Reduced-Form Evidence on Collateral Constraints [pdf]

with Thomas Chaney, Zongbo Huang, David Sraer and David Thesmar, Journal of Finance, 2022

This paper quantifies the aggregate effects of financing constraints. We start from a standard dynamic model of investment with collateral constraints. In contrast to the existing quantitative literature, our estimation does not target the mean leverage ratio to identify the scope of financing frictions. Instead, we use a reduced-form coefficient from the recent corporate finance literature that connects exogenous shocks to debt capacity to corporate investment. We embed the estimated model in a simple general equilibrium framework and find that, relative to a frictionless benchmark, collateral constraints induce output losses of 7.1%, and TFP (misallocation) losses of 1.4%. We show that these estimated economic losses tend to be more robust to misspecification than estimates obtained by targeting leverage.

- Countercyclical Labor Income Risk and Portfolio Choices over the Life Cycle [pdf]

Review of Financial Studies, 2022

Outstanding paper, Jacobs Levy Center Research paper prize

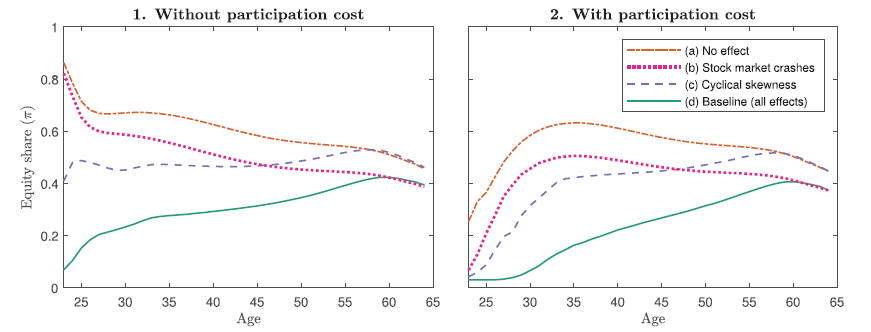

I structurally estimate a life-cycle model of portfolio choices that incorporates the relationship between stock market returns and the skewness of idiosyncratic income shocks. The cyclicality of skewness can explain (i) low stock market participation among young households with modest financial wealth and (ii) why the equity share of participants slightly increases until retirement. With an estimated relative risk aversion of 6 and yearly participation cost of $250, the model matches the evolution of wealth, of participation and of the conditional equity share over the life-cycle. Nonetheless, I find that cyclical skewness increases the equity premium by at most 0.5%.

Effect of countercyclical income risk on optimal equity share

- Keeping Options Open: What Motivates Entrepreneurs? [pdf][appendix]

Journal of Financial Economics, 2022

Editor’s Choice April 2022

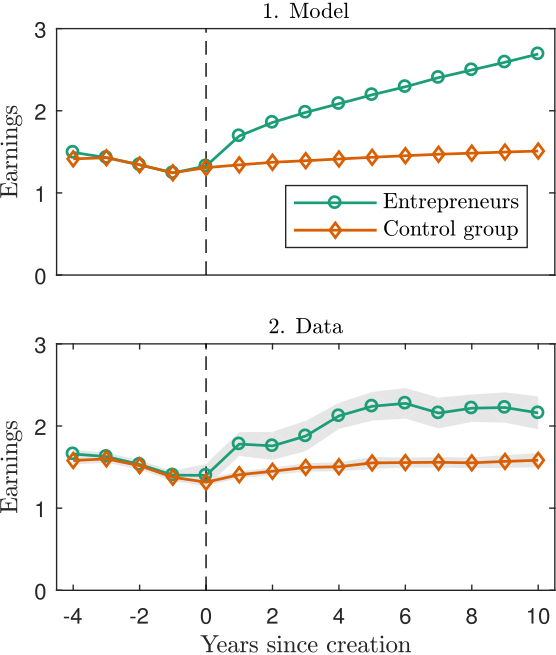

Using French administrative data on job-creating entrepreneurs, I estimate a life-cycle model in which risk-averse individuals can start businesses and return to paid employment. Then, I use the dynamic model to value the option of returning to the labor market in case of failure. For new entrepreneurs, this option is worth 6.4x the average net wage in the country, which represented 136,000 euros in 2018. This option value is explained by the unobserved heterogeneity in entrepreneurial abilities and the random-walk component of productivity. Estimated unobserved benefits of entrepreneurship represent 38.6% of the average net wage pre-tax per year (some 15% of profits), or 8,250 euros in 2018. Unobserved benefits add up to 90,700 euros over the average entrepreneurial spell. Together, unobserved benefits and the option value of returning to paid employment explain 42% of firm creations.

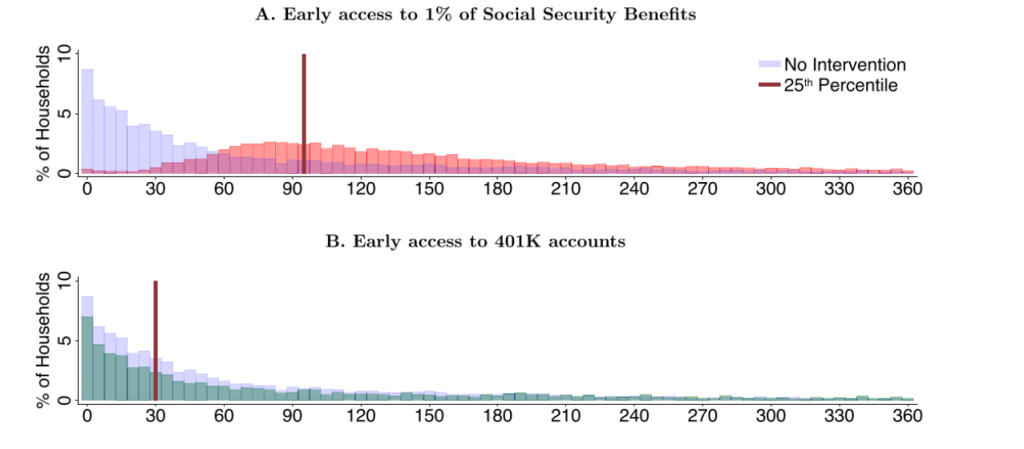

- Relaxing Household Liquidity Constraints through Social Security [pdf]

with Max Miller and Natasha Sarin, Journal of Public Economics, 2020

More than a quarter of working-age households in the United States do not have sufficient savings to cover their expenditures after a month of unemployment. Recent proposals suggest giving workers early access to a small portion of their future Social Security benefits to finance their consumption during the COVID-19 pandemic. We empirically analyze their impact. Relying on data from the Survey of Consumer Finances, we build a measure of households’ expected time to cash shortfall based on the incidence of COVID-induced unemployment. We show that access to 1% of future benefits allows 75% of households to maintain their current consumption for three months in case of unemployment. We then compare the efficacy of access to Social Security benefits to already legislated approaches, including early access to retirement accounts, stimulus relief checks, and expanded unemployment insurance.

Days to cash shortfall under different policies

Other publications:

- The Distributional Effects of Student Loan Forgiveness:

An Update on SAVE and the Covid Moratorium [pdf]

with Mark Pérez Clanton and Constantine Yannelis

National Tax Journal, 2024

Student loan forgiveness policies in the United States have undergone significant evolution and debate since 2020, with varying degrees of targeting and regressive implications. This paper offers an update on student loan forgiveness developments since 2020, evaluating recent proposals through the lens of the Catherine and Yannelis (2023) framework. We study the economic dynamics of student loan forgiveness in 2024, tracking proposed and implemented forgiveness measures and their distributional impacts. We find that new proposals expanding income-driven repayment are more progressive than a universal loan forgiveness plan, but caution against increased moral hazard at the school level.

- Social Security and the Racial Wealth Gap [pdf]

with Natasha Sarin

Chapter in Reducing Retirement Inequality: Building Wealth and Old-Age Resilience, Eds Olivia S. Mitchell and Nikolai Roussanov, Oxford University Press, 2025

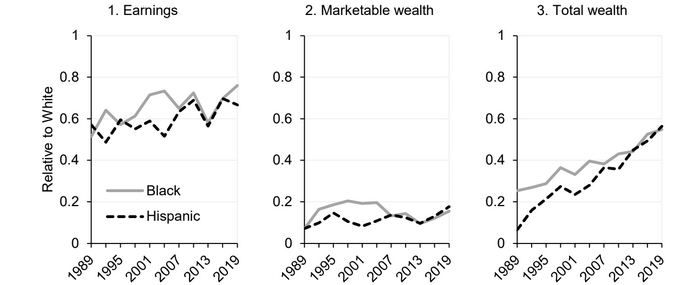

In the United States, the median Black household earns 30 percent less per adult than the median White household, yet the latter has over six times more marketable wealth than the former. We revisit this puzzle by expanding our wealth concept to include the present value of social security payments. Once social security wealth is accounted for, the racial wealth gap has narrowed over the last 30 years. In 1989, the median White American household owned over four times more total wealth than their Black and Hispanic American counterparts, but under twice as much in 2019. We argue for the importance of including social security in our study of wealth inequality, because of the role it plays in shaping the marketable wealth distribution and the recent rise in its value.

Median Earnings and Wealth per adult of Black and Hispanic Americans

relative to White families